Ma payroll calculator

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. How to calculate annual income.

Dmv Fees By State Usa Manual Car Registration Calculator

All Services Backed by Tax Guarantee.

. Ad Compare This Years Top 5 Free Payroll Software. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Payroll So Easy You Can Set It Up Run It Yourself.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. Payroll pay salary pay.

Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Ad Get Started Today with 2 Months Free. The tax is 351 per pack of 20 which puts the final price of cigarettes in.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. For example if an employee earns 1500. Just enter the wages tax withholdings and other information.

The results are broken up into three sections. Federal Salary Paycheck Calculator. SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes.

Ad Process Payroll Faster Easier With ADP Payroll. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Massachusetts has a flat income tax rate of 5 so an individual. This calculation is also subject to a cap that in 2022 is 64 of the SAWW. Paycheck Results is your gross pay and specific deductions from your paycheck.

Bay Staters can use an online calculator the Baker administration launched to get a projection of what to expect. Get Started With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Massachusetts Department of Revenue. This contribution rate is less because small employers are not. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Free Unbiased Reviews Top Picks. Get Your Quote Today with SurePayroll.

Free Unbiased Reviews Top Picks. Massachusetts Hourly Paycheck Calculator. Simply enter their federal and state W-4.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. So the tax year 2022 will start from July 01 2021 to June 30 2022. Massachusetts Cigarette Tax.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Enter your info to see your take home pay. For 2022 the new state average weekly wage is 169424 and the new maximum weekly benefit.

Ad Compare This Years Top 5 Free Payroll Software. This income tax calculator can help estimate your average. Get Started With ADP Payroll.

Massachusetts new hire online reporting. New employers pay 242 and new. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

Calculating paychecks and need some help. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. Below are your Massachusetts salary paycheck results.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

It will confirm the deductions you include on your. Back to Payroll Calculator Menu 2013 Massachusetts Paycheck Calculator - Massachusetts Payroll Calculators - Use as often as you need its free. Massachusetts has some of the highest cigarette taxes in the nation.

How To Calculate Payroll Taxes Methods Examples More

The Easiest Massachusetts Child Support Calculator Instant Live

Hourly To Salary Calculator

Calculate The Molar Mass Of Ethanol C2h5oh Molar Mass Practice Youtube

Massachusetts Income Tax Calculator Smartasset Com Income Tax Tax Income

3 Ways To Calculate Your Hourly Rate Wikihow

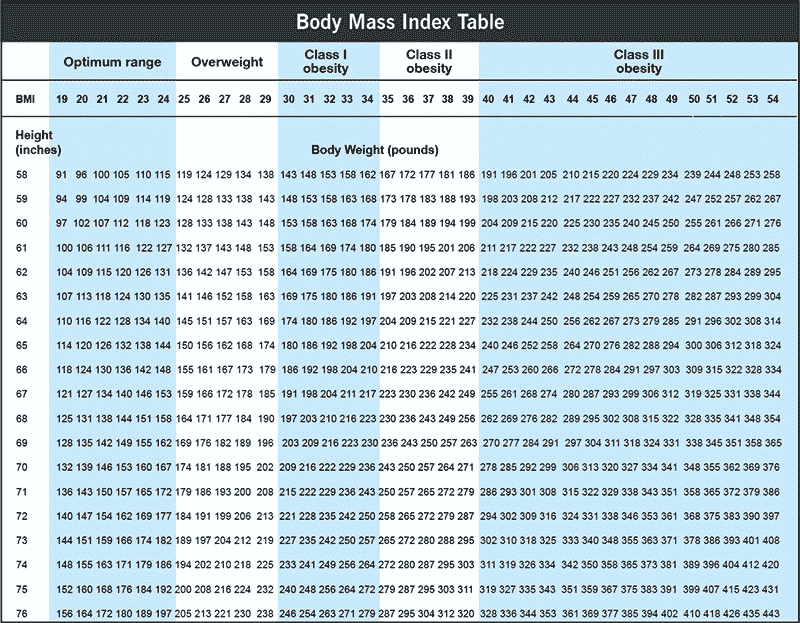

Bmi Body Mass Index What It Is How To Calculate

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Here S How Much Money You Take Home From A 75 000 Salary

Massachusetts Paycheck Calculator Smartasset

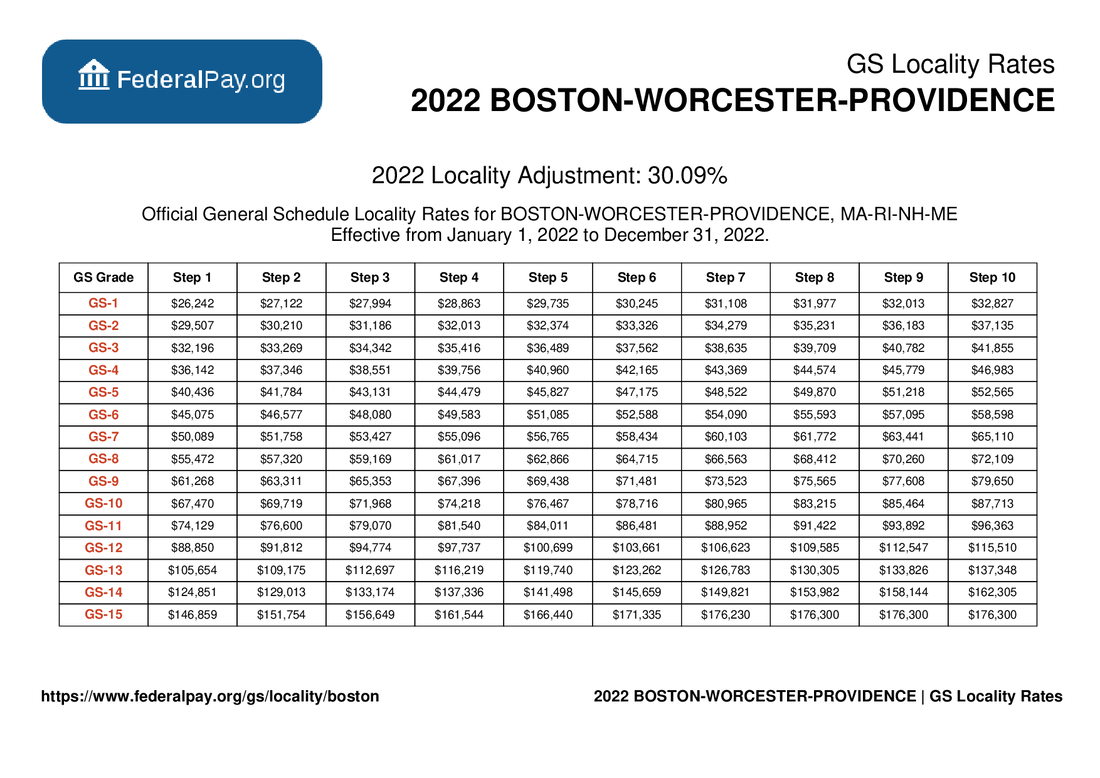

Boston Pay Locality General Schedule Pay Areas

Massachusetts Paycheck Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Net Pay Step By Step Example

Payroll Tax Calculator For Employers Gusto

Hourly Paycheck Calculator Calculate Hourly Pay Adp

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate